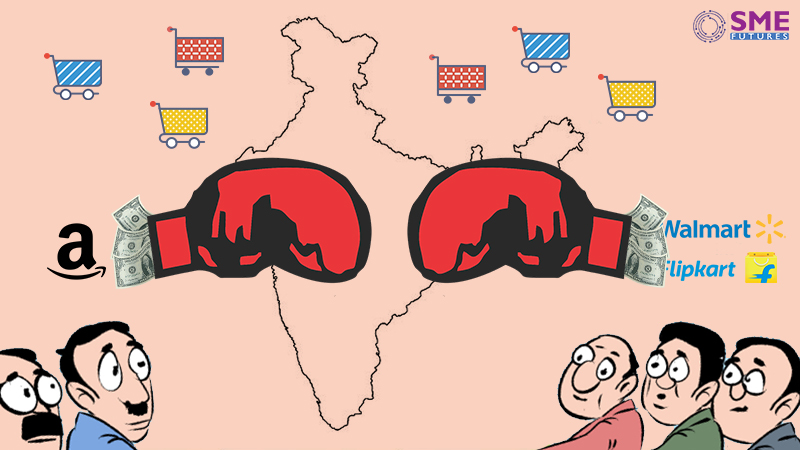

One of the world’s most dreaded and US largest retailer, Walmart, has found a foothold in India. The Bentonville-headquartered company in the Arkansas province of the US will own 77 per cent in Flipkart, which it has purchased for a cost of $ 16 billion from the founders and investors. Softbank holds 20 per cent stake in the company.

It is a triumphal return for the retail giant to Indian market, which had first entered India with Sunil Bharti Mittal-owned Bharti Group in cash and carry business. The joint venture between the two companies was called off in 2013 after charges of bribing Indian officials for which the company is said to have spent $334 million as compensation to its Indian partner.

Walmart and Indian e-commerce

Walmart is America’s largest corporation, with the global sales turnover of $495 billion in 2017. It has a history of eating up its big as well as small rivals. In 2008, the Journal of Urban Economics published a study titled “The Effects of Wal-Mart on Local Markets”, which noted, “The employment results indicate that a Wal-Mart store opening reduces county-level retail employment by about 150 workers, implying that each Wal-Mart worker replaces approximately 1.4 retail workers. This represents a 2.7 percent reduction in average retail employment. The payroll results indicate that Wal-Mart store openings lead to declines in county-level retail earnings of about $1.4 million, or 1.5 percent.”

There are many other such studies on Walmart that suggest that wherever the giant retailer opens its shop, the mom-and-pop retailers have to pack their bags within months. Like a research report published in the Financial Post in 2016 said, “The Town’n Country grocery in Oriental, North Carolina, a local fixture for 44 years, closed its doors in October after a Walmart store opened for business. Now, three months later – and less than two years after Walmart arrived – the retail giant is pulling up stakes, leaving the community with no grocery store and no pharmacy.”

Should India worry?

According to media reports, online sellers on Flipkart are jittery because of the Walmart’s history of taking business away from the smaller players. Walmart is a $500 billion American retail giant with a reputation of killing small businesses by offering extremely low prices to customers. In case the Walmart gets its own private labels, it could mean the end of business for smaller vendors in the country, as a large number of people in the urban centres have already become used to shopping online. “Currently Walmart and its products are not present on Flipkart’s marketplace. This deal will enable Flipkart to give benefits to Walmart products, which will lead to unnatural gain and diluting the B2C market both online and offline where Walmart has zero presence,” a spokesperson of the All India Online Vendors’ Association (AIOVA), which has 3,500 sellers on large platforms like Flipkart and Amazon, told SME Futures.

According to policy analyst Mohan Guruswamy, “Of the $317 billion sales in America, estimates say that Chinese suppliers make up 70 to 80 per cent of Walmart’s merchandise, leaving less than 20 per cent for US-made products.” If Walmart uses the same strategy to sell for its India operations, the move is likely to give small Indian vendors sleepless nights in the coming months.

Walmart has more than 350 stores in 130 Chinese cities, with a total turnover of $7.5 billion. India’s trade deficit with China was $54 billion last year. The entry of Walmart, with China as its sourcing hub, could increase India’s trade deficit to unimaginable numbers in the coming years.

Legal bulwark

The rules of the Indian e-commerce sector restrict a foreign-capital-funded e-commerce company to the marketplace model. Under the marketplace model, an entity can provide an information technology platform on a digital and electronic network to act as a facilitator between buyer and seller. This means that Walmart will not be able to have its own inventory of products to pay heavy discounts to consumers, something it has done in countries where it is present through its brick-and-mortar supermarkets.

This rules makes Walmart dependent on the local suppliers for sourcing of products and giving them huge volumes to price the products at the lowest possible profit margin.

The Amazon challenge

The acquisition of Flipkart does give Walmart a chance to take on its US-based rival Amazon inc that has been eating into the former’s business for many years now. Amazon entered the Indian market in 2012 and controls about 31 per cent of the online retail market, according to Forrester. The Seattle-headquartered company is breathing down the neck of Flipkart, which, along with its fashion units, controls nearly 40 per cent of India’s online retail market, according to industry estimates. Walmart’s entry into online retail is a sort of a counter punch by the physical retail giant to Amazon, which has entered offline retail by picking up a $27.6 million stake in Indian retailer Shopper’s Stop.

The two companies would be pitched in a cash-guzzling battle in India. Flipkart has already burnt $2.32 billion of cash between 2014 and 2017. But Amazon has already committed investments worth $5 billion for its India operations and has just announced infusion of $380 million in the wake of Walmart’s acquisition of Flipkart.

In a recent investor call, Amazon CFO Brian Olsavsky had told stakeholders that the company would continue to invest in its India business as it sees great progress with both sellers and customers here, even though the US-based e-commerce giant registered a loss of $622 million from international operations in the first quarter of 2018.

Government’s intervention

With both the warring parties flush with US dollars, if the government manages to control imports from China and a fair play by both the online retail giants as per the rules of marketplace e-commerce rules, one can expect a huge bonanza for the suppliers – big and small – to sell their products on these e-commerce platforms. With the entry of Walmart in India, both Amazon and Walmart will have to offer newer schemes and discount offers not just for buyers but also for sellers, who the retailers would want to get into exclusive deals with.