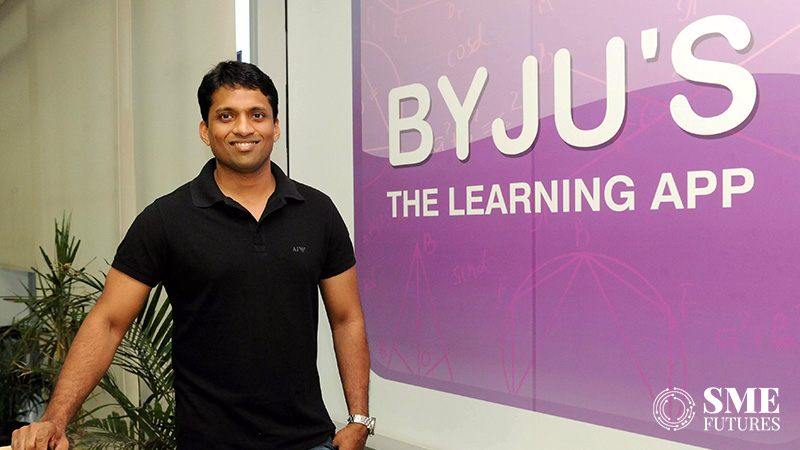

Troubled edtech company Byju’s on Wednesday said the Enforcement Directorate’s notice received by the company is related to technical issues such as delay in filing Annual Performance Reports (APR) with respect to foreign direct investment of Rs 8,000 crore and it expects nominal penalty, if any, in the matter.

The company in a statement said that the delayed filing of APR is a “technical issue and the company is confident of successfully dealing with the case”.

The Enforcement Directorate on November 21 issued a foreign exchange violation show cause notice of more than Rs 9,300 crore against Byju’s and its CEO and co-founder Raveendran Byju.

The agency had mentioned multiple grounds for charging the company in the notice and stated that post final adjudication, it has powers to penalise FEMA violators up to three times the value of the amount mentioned in the show cause notice.

On the ED notice, Byju’s said, “The company has, however, filed requisite intimation contemporaneously for all FDI which is received in accordance with the eligibility criteria in law and not affected by the alleged non-filing of APR.” Dispelling allegations of “wrong doing” in relation to receipt of FDI or allotment of shares, Byju’s claimed that it has issued or allotted shares within the prescribed time against the FDI so received.

“This is being clarified to the company is advised that the delayed filing of APR (particularly when returns in relation to receipt of FDI have been filed in time) is a technical issue and the Company is confident of successfully dealing with the case.” “Based on precedent actions by the Adjudicating Authority, we anticipate that the fines, if any, will be nominal,” Byju’s said.

The Late Submission Fee for such reporting delays that can be imposed pursuant to the RBI regulations with respect to APRs is very nominal (Rs 7,500) and by no means does the notice denote a fine, it clarified.

“The ED notice does not specify any quantum of fine but rather highlights the quantum of FDI/ODI (~ 9,000 crore) along with the deadlines that we missed in the reference period for this quantum,” Byju’s stated.

“We want to reassure you that Byju’s maintains and will continue to maintain complete adherence to all relevant FEMA regulations, as verified by comprehensive due diligence conducted by reputable law firms,” the company added.

The federal probe agency mentioned multiple grounds for charging the company and its chief promoter that included charges of “failing” to submit documents of imports against advance remittances made outside India; failing to realise proceeds of exports made outside India by delayed filing of documents against the Foreign Direct Investment (FDI) received into the company, among others.