Running a small business is exciting:

- Building something of your own from scratch.

- Developing a good product or service.

- Forming the right team.

- Working on tight budgets and tighter deadlines – all to give shape to an idea and make it a reality.

However, running a Small and Medium Enterprise (SME) is a roller coaster ride, too, with several highs and lows.

To effectively battle the ups and downs of the SME world, having to sound financial health is not just crucial but inevitable to keep business operations running smooth and building resilience against changing business ecosystem. The Covid-19 pandemic and the business disruption, payment cycles and revenues that followed is a classic scenario to consider: Businesses battled the worst liquidity crisis. However, not just corporates and giants but even SMEs with sound financial health managed to scrape through well and bounced back faster than their counterparts. Such a phenomenon underlines the need for timely and regular financial planning.

Changing times and a dynamic business environment calls for SMEs to constantly adapt to newer financial and growth strategies, making financial planning more extensive. SMEs do not have bigger cash reserves or fertile revenue streams. Therefore, financial planning for SMEs is a step ahead of planning for your personal finances and involves building a liquidity corpus, investing your money right by diversifying your assets, risk management and estate planning, among various aspects.

A few time-tested best practices SMEs adopt in their financial planning have certainly helped small and medium businesses chart out successful growth strategies.

Set your financial goals

Charting out a financial plan is well all about setting goals, both short term and long term. That doesn’t just mean writing all you want and all you need to do to achieve it. Financial planning is looking at the bigger picture that helps you wisely manage the business and personal finances. Experts recommend that this involve setting realistic financial goals for your business and yourself, evaluating your current financial situation and identifying how you need to mobilise your assets and resources and monitor your goals from time to time.

Maintaining liquidity

In the fast-changing business environment, maintaining liquidity is crucial. This doesn’t just mean setting aside a lump-sum amount. We saw a raging pandemic and a sudden lockdown that brought businesses to a standstill leaving every revenue stream dried up. To meet operating expenses and overheads, a contingency fund is all that came in handy. Therefore, it is crucial to building a cash cushion that will support your business for at least six months to meet cash flow needs in the hour of crisis. Ideally, financial sector experts emphasise at least a year of cash flow, but SMEs can start slow and keep building.

Invest Wisely

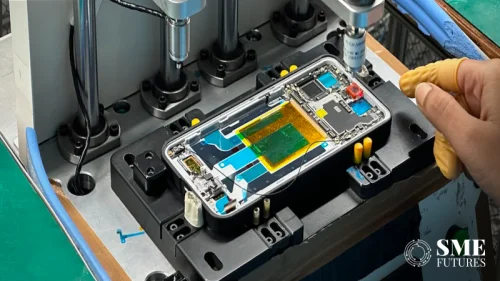

Building financial assets by wisely investing your contingency corpus and other money is crucial to attaining long-term business goals. Even though SMEs don’t have a large cash reserve, balancing your business investment by not putting all eggs in one basket is wise. It makes SMEs safeguarded against risks.

A very typical trend observed among entrepreneurs is the tendency to keep investing in their own firm. It is excellent to invest surplus money to fund one’s own business needs, but it is equally important to diversify asset classes. Prudent planning must be focused on diversification. Financial planners always recommend balancing off business investments in appropriate proportions into cash, bonds, stocks and real estate. With this, the portfolio will help harvest cashflows for your business, not just for exigencies but also for meeting business expansion requirements in the longer run.

Debt Management

Be it for growth and expansion or simply for meeting working capital requirements, every business has financing requirements from time to time. For the sound financial health of your business, effective debt management can be achieved by developing a good business plan – determine what your business needs, whether it is possible to fund it from the SME’s own corpus partly, and how will the borrowing chart out your growth in future. It is crucial to estimate what your business will generate to cover the debt. At the same time, weigh all the financing alternatives well and arrange for your credit resources well in advance.

Stay Insured

Please protect what you value, be it your business assets and property or safeguarding your business against disruptions and disasters is the most crucial to financial planning. While a contingency fund and investments sure come in handy in the hour of crisis; however, a financial planner will always advise an SME to put essential safeguards in place to make way for risk mitigation.

Therefore, protecting your legal liabilities, physical assets and finances against foreseeable risks must be factored into an SME’s priority.

Tax planning

Tax compliances have always remained a daunting task for all SMEs. With changing regulations year after year, SMEs need to be agile in their tax planning. In small businesses with limited cash reserves, prioritising business and finance needs and not undermining them while opting for tax savings is crucial. Saving taxes must complement your financial needs and not necessarily dominate your business needs. It is important that your tax and financial planners be abreast with the latest tax regulations and advise you on tax savings opportunities through core business processes such as EPF Schemes and insurance coverage.

Business Succession Plan

No business is slated to remain stagnant, and growth is only inevitable. The business owner may wither, but the show must go on; the enterprise you’ve built is here to stay. Given this scenario, planning for the succession of your business is a foreseeably logical move.

Setting a succession goal, doing the groundwork for the years to come and putting an exit strategy in place are some of the most common requirements to your business succession planning – be it division equitably among heirs, or selling off the stake or else. While setting this goal, it is vital to ensure that tax planning and insurance being in a place while factoring in death, disability or an unforeseen circumstance to fund your business when succeeded.