For decades, India’s middle class has been the silent force powering the nation’s growth. They are the diligent taxpayers, the prudent savers, and the engine of the economy. Yet, when budgets came and went, they often found themselves wondering: Where’s our piece of the pie? This year, that sentiment changed.

The Union Budget 2025, unveiled by Finance Minister Nirmala Sitharaman under the visionary leadership of Prime Minister Narendra Modi, isn’t just a document of policies—it’s a heartfelt letter to India’s middle class. It acknowledges their struggles, honors their contributions, and reignites their dreams. If you’re a salaried professional, a small business owner, or an aspiring entrepreneur, this budget speaks directly to you.

However, amid the relief and optimism, some critical challenges in the government’s fiscal strategy also need to be addressed. Let’s explore the highlights and the missed opportunities of this year’s budget.

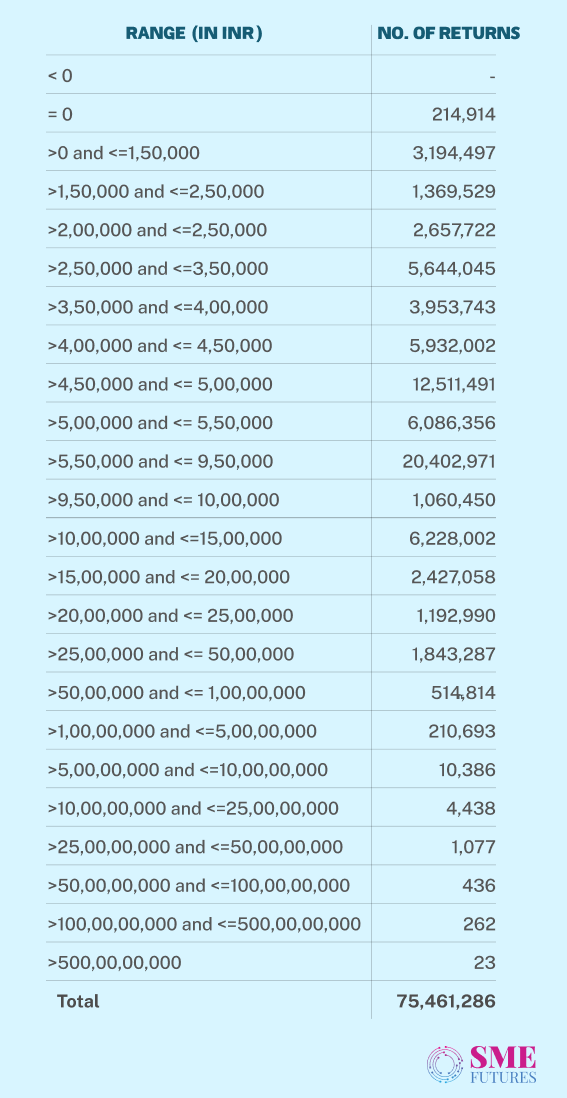

A tax revolution: 6.9 crore Indians rejoice

Imagine this: Nearly 6.9 crore people who previously paid income tax on their earnings under ₹12 lakh annually will now fall outside the tax bracket entirely. This sweeping reform means that millions of households will save thousands—if not lakhs—of rupees each year.

To put it into perspective, an individual earning ₹10 lakh annually under the old tax regime paid approximately ₹1,17,000 in taxes, while someone earning ₹12 lakh paid ₹1,79,400. Multiply this across the 6.9 crore taxpayers in this bracket, and the impact is staggering. The revenue previously collected from this group contributed significantly to the government’s tax coffers. But now, these savings will go directly into the pockets of taxpayers.

This monumental shift reflects Finance Minister Nirmala Sitharaman’s belief that empowering the middle class will ultimately benefit the economy. “By putting more money into the hands of the middle class, we are not just alleviating their financial pressures but also fueling growth through higher consumption and investment,” she explained during the budget presentation.

Silent struggle: Fiscal challenges in spotlight

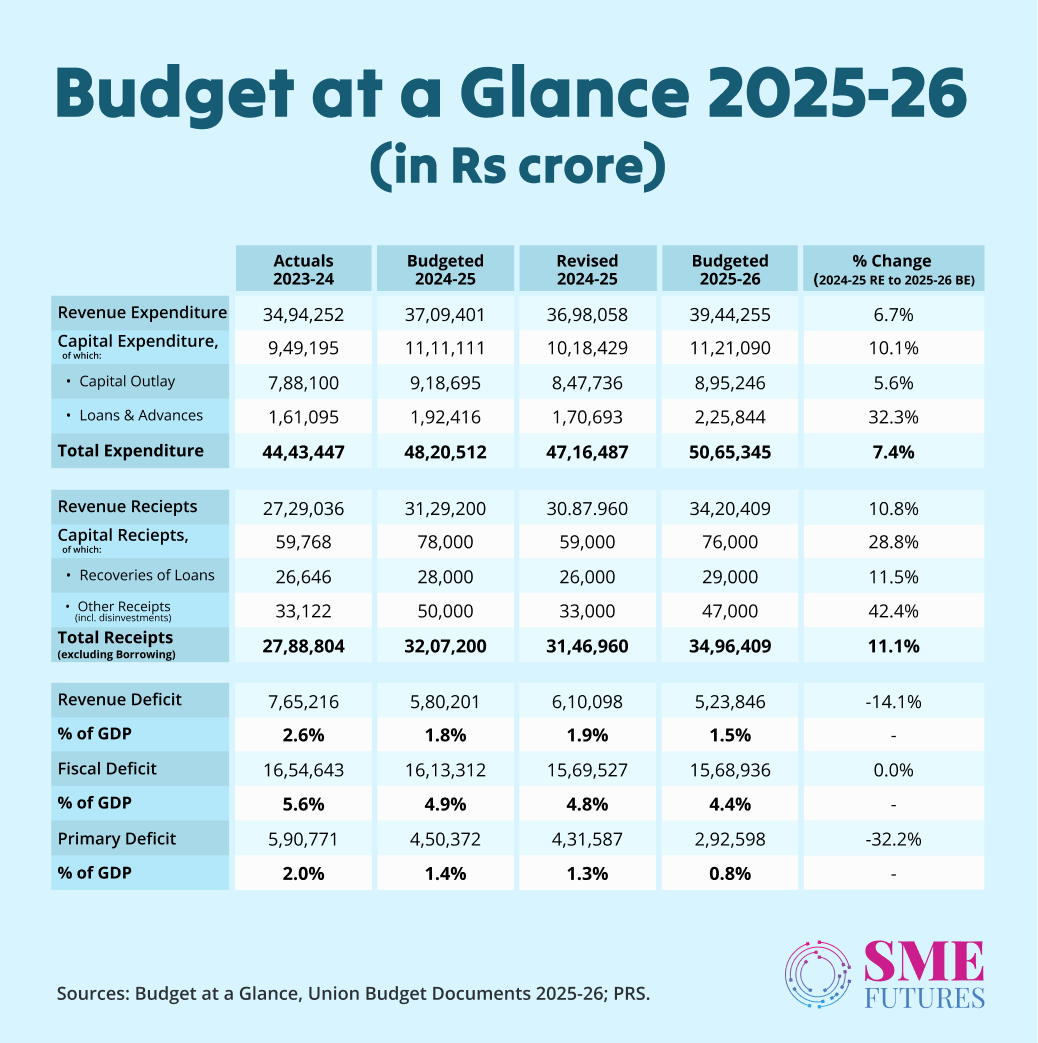

While the budget delivers substantial relief to the middle class, it also exposes deeper fiscal challenges. The government’s expenditure as a percentage of GDP is projected to decline from 16.03 per cent in FY22 to 14.19 per cent in FY26, signalling a contraction in government activity and spending. This is primarily due to the reliance on expenditure cuts, especially in revenue expenditure, which is projected to drop from 12.81 per cent of GDP in FY23 to 11.01 per cent in FY26.

Furthermore, there has been underspending in capital expenditure, with nearly ₹1 lakh crore below FY25 projections. This raises concerns about the government’s ability to finance essential public services and investments while adhering to fiscal consolidation targets.

The stagnation of the tax-to-GDP ratio, hovering at 7.9 per cent% over the past three years, compounds these challenges. Without a significant boost in revenue, the government’s strategy to balance fiscal prudence with economic growth might face roadblocks.

Healthier lives, wealthier minds

The middle class knows the anxiety of a medical bill that wipes out years of savings. This budget does not just talk about health—it acts on it. From expanding health insurance under public-private models to introducing low-cost options for critical diseases, the focus is clear: no family should be one hospital visit away from financial ruin.

This initiative aligns with PM Modi’s broader vision of “healthcare for all,” ensuring families have access to affordable, quality healthcare. These measures reflect not just policy changes but a genuine commitment to a better quality of life.

The missed opportunity: Jobs, jobs, jobs

While this budget is undoubtedly a middle-class bonanza, one glaring oversight stands out: job creation.

Though there is mention of up-skilling the workforce, particularly in AI, robotics, and other emerging technologies, there are no concrete steps to directly address job creation in traditional or new-age sectors. For a nation with a burgeoning young population, job opportunities stay a pressing concern. While skill development programs prepare the workforce, the lack of industry-specific incentives to create employment dampens the excitement.

The government has done well to focus on growth through consumption and investment, but a stronger emphasis on creating jobs—whether through infrastructure projects, manufacturing incentives, or start-up growth—could have turned this budget into a holistic economic masterstroke. The middle class thrives when their incomes are steady, and job creation is the foundation for that.

The bigger picture: Balancing priorities

This budget reflects a government walking a tightrope between fiscal prudence and middle-class relief. While it delivers on the latter, it also underscores the limitations imposed by revenue constraints. With shrinking expenditure as a percentage of GDP and stagnant tax revenues, the government’s ability to sustain ambitious reforms and public spending will remain a challenge.

That said, the budget’s focus on empowering the middle class has far-reaching implications. By putting over ₹1 lakh crore back into the hands of taxpayers, the government has ignited a cycle of higher consumption, savings, and investments—essential ingredients for economic growth.

A step forward, with more to go

The 2025 budget is more than numbers and policies—it is a vision of a fairer, more inclusive India. It recognises that the middle class is not just a statistic; it is the heartbeat of the nation. It gives them the tools to grow, the confidence to spend, and the security to dream bigger.

However, this vision cannot be fully realised without addressing the twin pillars of job creation and fiscal stability. As Finance Minister Nirmala Sitharaman and Prime Minister Modi move forward, the next challenge will be ensuring that these measures translate into tangible opportunities for India’s youth while balancing the government’s fiscal responsibilities.

For the middle class, this is not just a budget. It is an opportunity. It is the government’s way of saying: We see you. We value you. Let us build this future together. But it is also a reminder that economic empowerment requires continuous effort, careful planning, and, most importantly, the creation of jobs that will make aspirations a reality.