A lot has been said about women’s roles in boosting a nation’s economy. The crux of these discussions lies in the fact that employing more women or an increase in the number of women entrepreneurs will most likely lead to a surge in revenue generation. For example, in the US, women-owned ventures increased the economic growth rate to 4.5 times more than men-owned ventures, between 2022 to 2023 as per The Washington Informer. This clearly indicates the huge financial impact that women leaders can have.

A recent study by the McKinsey Global Institute says that globally, employing more women would probably add $12 trillion to the world economy by 2025 and that could jump to $28 trillion under favourable circumstances.

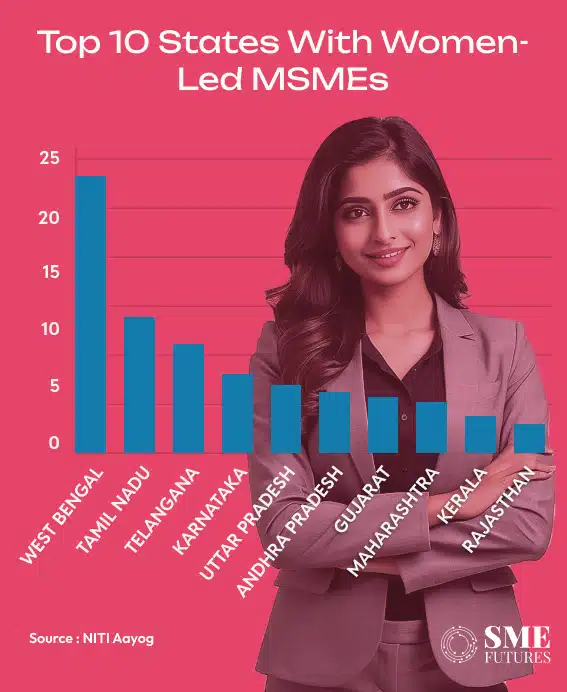

As for India, a lot still needs to be done to increase the participation of women in businesses here. As far as MSMEs are concerned, a 2022 report by NITI Aayog reveals that women own only 20.37 per cent of the total 63.38 million MSMEs in the country, which amounts to 12.39 million. This vast difference can be regarded as a heavy setback in terms of achieving our economic goals.

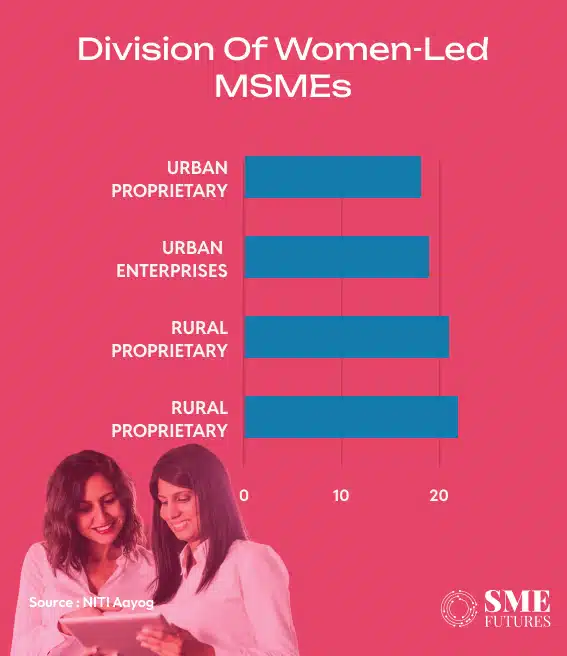

The Ministry of Micro, Small and Medium Enterprises’ (MoMSME) annual report shows that there is a slightly greater number of women leaders in MSMEs in rural areas as compared to the urban areas. This is certainly a sign of the progressive attitude of rural women. In the urban sector, the number of female employees is 12.74 million and in the rural sector, it is 13.75 million.

Encouraging more women entrepreneurs and job seekers can change the economic upliftment scenario in the country. Along with the government, NGOs can also play a pivotal role in motivating more women to take up a career as per their skillset or start a business of their own.

We spoke to Swapna Abraham, who is the India Country Chair, G100 Media Arts & Communication and a member of the Governing Council/Academic Advisory Board. She says, “Women have an innate ability to be more perceptive. This enables them to better understand the consumer/customer, helping organisations to make the necessary corrections to augment their businesses.”

Abraham adds, “Women are also better ambassadors of culture. One cannot stress enough on how an organisation that is well rooted in its culture demonstrates better results like lower attrition, higher productivity, higher employee morale and engagement and eventually better commercial outcomes.”

For a broader perspective, we also need to know what men as business leaders and employees think of women’s contribution to business. In this context, we spoke to Deepak Goel, Founder and Editor at realtyninfra.co.in.

He says, “Various organisations that employ women in large numbers have proven to be more profitable and even provide higher-quality customer experiences. Adding more women to the workforce can lead to the higher economic growth of any nation, leading to better socio-economic outcomes. It’s time that governments, academia and intelligentsia pushed for greater gender diversity at workplaces.”

How to close the gender gap?

Closing the gender gap in MSMEs is crucial for enhancing financial growth. More women in the workforce will lead to a brighter economic future. Sustainable growth can result from the development of policies that explicitly meet the needs of MSMEs run by women. For example, switching to digital payments from cash lowers transaction costs and increases accessibility. Financial products that are women-specific (consumer-level) and need women-centric entrepreneurship can also help to fill the gender gap. This could be in the areas of personal hygiene, women’s health, individual-level initiatives, etc.

It is essential to promote digital financial services and make those accessible to women. Women’s negotiating power in economic activities can be enhanced and transactions made more inexpensive as access to digital platforms grows. Training programmes that can help women to become digitally literate can play a crucial role in encouraging them to grow and join the workforce. Digital literacy can also help women in understanding businesses more and in finding out more ways of becoming self-sufficient by using online tools to their advantage.

Building trust and promoting participation in formal financial systems requires financial institutions to treat women-led MSMEs fairly, which is ensured by implementing transparent laws. In advancing the role of women in MSMEs, different stakeholders can play pivotal roles. Governments as stakeholders can prioritise the policies that are gender-sensitive so that at the national level, the inclusion of women in the workforce is accelerated. Financial institutions as stakeholders can develop and promote women-specific roles and products, along with ensuring equitable access. Also, civil society organisations as stakeholders can facilitate and promote training and awareness programmes that empower women entrepreneurs and motivate more women to create their own identities and contribute to the economy.

Social hindrances in women’s participation

Even in the 21st century, a woman faces many challenges when she steps out of the house to work. The main personal challenge is motherhood. Apart from the pregnancy period followed by maternity leave, a woman needs a lot of support to perform her professional duties and run a business along with raising a child in a safe and healthy environment. Women who have a supportive family can manage quite well but those who do not have such help often quit their jobs for more than three to five years, which pushes them behind in their careers.

Conversely, many women who are at higher positions can afford daycare facilities, but their children’s safety and growth are a constant source of worry for them. In many instances, women quit their rewarding and high-paying jobs after marriage or children due to societal pressure. Also, in traditional households, women are only regarded as homemakers, and do not have enough access to financial resources.

Combating social pressures and standing up for oneself is effective but comprehensive regulations and policies are required to include more women in the workforce. Also, all businesses, big or small, should be open to providing a cooperative environment and facilities for women who are new mothers. An organisation must encourage a woman who is on maternity leave to rejoin and perform even better than before.

Another norm in society is that if both the man and the woman are earning, even if the woman is at a better position, the man is still considered the primary breadwinner. At the family level, a rational distribution of financial duties can help to change the mindsets of both men and women. All duties, whether household or financial, should be shared equally.

In many business families, patriarchy persists, and women cannot take up the family business or start a business of their own. Similarly, discriminatory attitudes towards women do not let them study or take up entrepreneurship roles or work outside. These mindsets need to change for the betterment of not just society but for true and sustainable growth to occur on a global scale.