Its the first day for Ola IPO (Initial Public Offering). According to the latest reports, till 11:51 IST, Ola Electric IPO subscription status is 18%, as per BSE data. The bid ends on 6th August.

With this IPO, the company plans to expand its operations, enhance its product offerings, and strengthen its position in the competitive EV industry.

About OLA Electric

OLA Electric, founded in 2017, is the EV arm of ANI Technologies, the parent company of OLA Cabs. The company’s mission is to ensure that clean mobility solutions are accessible and affordable to the masses. OLA Electric has seen significant growth over the past few years. In the fiscal year 2023-2024, the company reported revenue of Rs5243.27 crore, marking a substantial increase from the previous year’s Rs2,782.70 crore. This growth is attributed to the robust sales of its electric scooters and the expansion of its charging infrastructure across India.

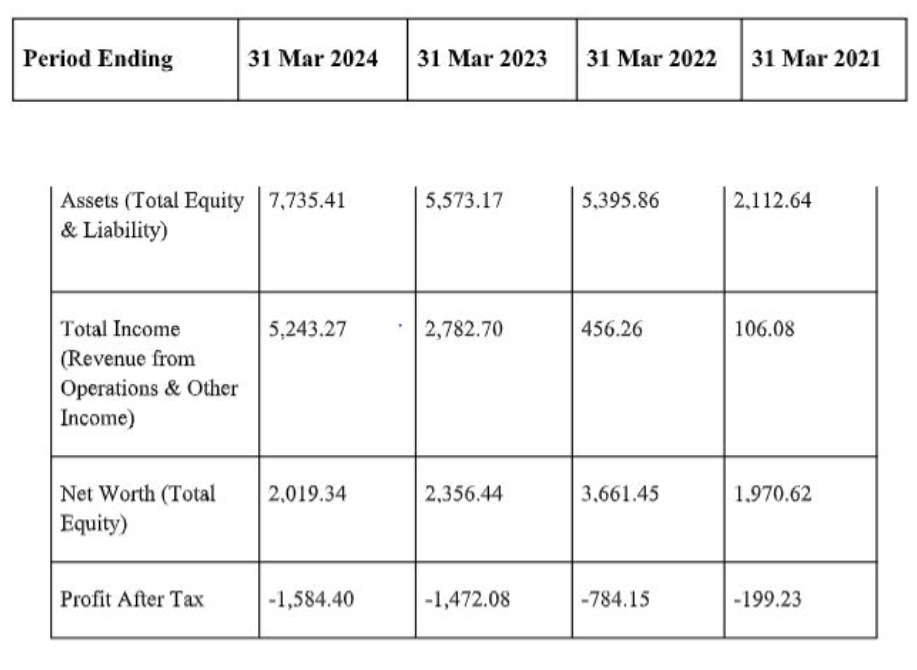

Financial Information on OLA Electric

Here’s the restated consolidated data on the company’s assets, net worth and profits in Crores:

Market Position and Products

OLA Electric’s flagship product, the OLA S1 scooter, has been a significant contributor to its revenue. The company has also been focusing on developing a robust network of charging stations to support its growing customer base. By the end of 2023, OLA Electric aims to have over 10,000 charging points across India, ensuring convenient access for EV users.

Details of the OLA Electric IPO

The OLA Electric IPO aims to raise approximately Rs6,000 Crore, which will be utilised for various purposes, including expanding manufacturing capabilities, enhancing research and development, and strengthening the company’s charging infrastructure.

Key Highlights of the IPO

- IPO Size: Aggregating up to Rs6,145.56 Crore

2.IPO Date: 2nd August 2024 to 6th August 2024. - Face Value: Rs10 per share.

- Offer for Sale (OFS): 84,941,997 shares (/topic/shares) of Rs10 (aggregating up to Rs645.56 Crore.)

- Fresh Issue: Aggregating up to Rs5,500.00 Crore

- Price Band: The price band for the IPO is expected to be in the range of Rs72-Rs76 per share.

- Lot Size: Investors can bid for a minimum of 195 shares (/topic/shares) and in multiples thereof.

- Listing: The shares (/topic/shares) will be listed on both the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE).

Great. You did a deep research.