The on-going conflict between Iran and Israel has further exacerbated the unstable situation in the Middle East. For decades, these two nations have been engaged in a proxy war, trading attacks through cyberspace, sea, land, and air. This strife at the global level avoided any physical involvement and thus prevented massive destruction. Sadly, the current scenario is different as the war is not limited to trade or diplomatic attacks anymore and is leading to destruction and agony on both sides.

World leaders are urging Israel to maintain peace and stability while it continues to retaliate to the drone and missile attacks by Iran. On the other hand, Iran is determined to act with its maximum potential to even the tiniest action by Israel. Now, the situation is such that a retaliation by either of the two nations would hugely impact the stock markets.

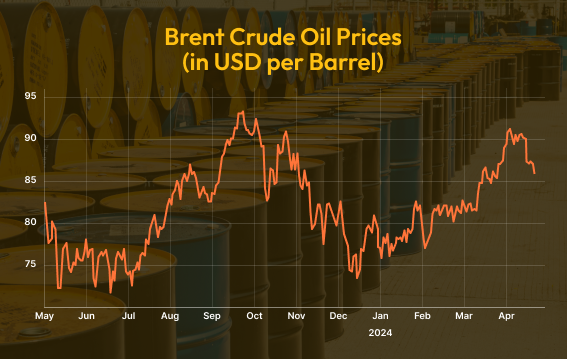

This on-going tension has increased geopolitical risks in the oil market, which could supposedly push the prices to even $100 per barrel. So far, the maximum price rise shown by Brent was $92.18 per barrel soon after Iran attacked Israel on April 13, 2024. The prices declined two days later but the volatility remains.

Supply might sustain while affordability of oil buyers will be affected due to price rise

As far as India is concerned, 83% of its oil needs are met through import, with the Middle Eastern nations being its major oil suppliers. Instability in the Middle East will affect its oil export rates to other countries. Both physical supply and price affect the shipping of production oil or refined products. Luckily, till now shipping has not faced any disruption, which means that oil is available, and its suppliers are able to export it. But pricing might be affected as the market is ruled by sentiments that can change from time to time. Unsurprisingly, Brent shoots up one day and falls on the next.

If the Iran-Israel conflict persists for long, the prices will continue to rise. Iran as the founding member of the Organization of the Petroleum Exporting Countries (OPEC) can heavily impact the rise in prices. It is the seventh largest oil producer in the world and the third largest oil producer among the OPEC countries. Therefore, Iran’s role can be a reason for the slippage of the share market in the Asia-Pacific region. The strait lying between Oman and Iran is a significant route for oil tanker shipping and it is the base of supply for 20% of the oil in the world. However, the prices might rise without any decline in supply.

Potential consequences of a further hike in oil prices include challenges for central banks. Higher oil prices could lead to prolonged inflation that would delay rate cuts and impact global economic growth negatively. Market reactions are influenced by geopolitical developments and the actions of key players in the Middle East region.

In the past, oil prices have deeply impacted the global economy. Oftentimes, OPEC members including Iran have caused supply disruptions that have led to inflationary situations. Presently, the situation is a bit different because non-OPEC member countries including Malaysia, Azerbaijan, Kazakhstan and Mexico are exporting more oil as compared to OPEC. Exporters other than OPEC can help to manage the crisis, however, again supply would not be an issue, but price hike would be.

The conflict between Iran and Israel has already caused significant damage to both nations. It is imperative that the international community intervenes to prevent a further escalation of the conflict. World leaders must urge both nations to engage in diplomatic talks and find a peaceful solution to their differences. Also, the international community must work towards stabilizing the oil market and preventing further price hikes.

Role of oil prices in global economy:

Enhancing the global economy – Oil prices play a pivotal role in stimulating the global economy. Higher oil prices can enhance economic activity by reducing manufacturing and transportation costs, thereby fostering economic growth. Conversely, lower energy prices can have adverse effects on U.S. oil companies and domestic oil workers.

Direct effect on national economies – The influence of oil prices on a country’s economy is contingent on its economic structure. Nations heavily dependent on oil trade are more susceptible to fluctuations in the global commodity market. While a rise in oil prices can benefit oil-exporting countries, it may harm oil-importing nations, impacting their inflation rates and economic growth.

Inflation and central bank policies – Elevated oil prices can lead to prolonged inflation, potentially delaying rate cuts by central banks and negatively affecting global economic growth. The correlation between oil prices and inflation is intricate, with multiple factors shaping the overall economic environment.

Demand and supply – Oil price fluctuations are driven by both supply and demand factors. While a decrease in demand can contribute to lower oil prices, increased supply from countries like the U.S. and non-OPEC members can also influence global oil prices. The equilibrium between supply and demand is critical in determining oil prices and their economic repercussions.

Monetary policy response – The response of monetary authorities to oil price changes is vital in mitigating short-term impacts on output. Central banks must consider unexpected oil price shifts when formulating monetary policies to manage effects on real GDP growth, inflation rates, interest rates, and exchange rates.

All in all, oil prices significantly impact the global economy, influencing economic growth, inflation, banking, and the overall economic stability of nations worldwide. The intricate relationship between oil prices, supply and demand dynamics, and monetary policy responses underscores the importance of closely monitoring and comprehending the implications of oil price fluctuations on the global economic landscape.

It would not be an exaggeration to say that tensions in the Middle East impact economic growth at the global level, as a majority of these countries are big players as producers and exporters of crude oil.