The Economy Observer report by Dun & Bradstreet (D&B), a leading global provider of business decisioning data and analytics, shares projections for critical economic indicators, accompanied by commentary and insights into the most recent economic trends.

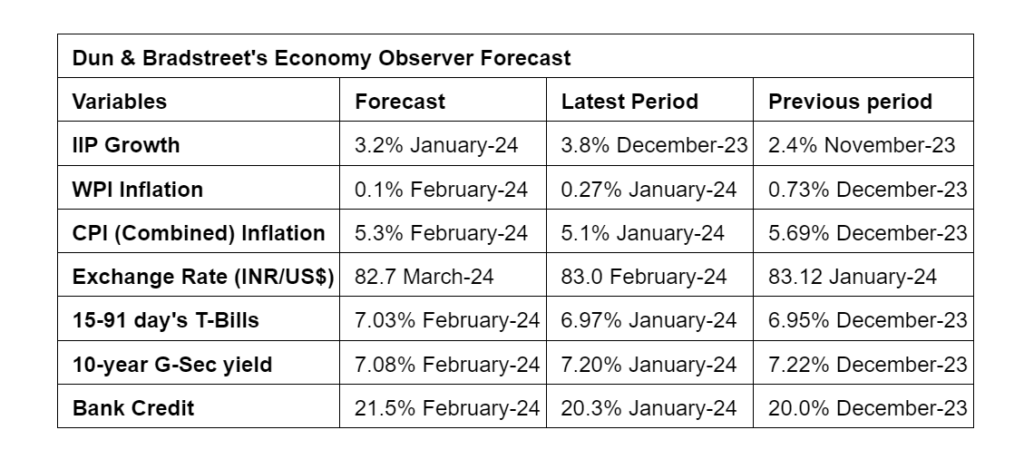

Key economic forecast:

Real Economy: The Index of Industrial production (IIP) is expected to have registered a moderate growth in January 2024, owing to factors such as the waning of demand post the festive season, pre-election apprehension amongst businesses and likely impact of a high interest rate regime on small businesses. The slowdown in the manufacturing sector is a concern. However, the significant allocation to the capital expenditure in the Union Budget for 2024–25 is expected to drive activity, particularly, in the capital goods and infrastructure segment going ahead. D&B expects the IIP to have grown by 3.2% in January 2024.

Price Scenario: Rise in global oil prices is imparting an upward pressure to the inflation. Stickiness in the domestic price for certain food products, such as pulses, spices and vegetables, along with frequent disruptions in the global supply chain is likely to keep retail inflation above the RBI’s target of 4% in the near term. Dun & Bradstreet expects the Consumer Price Inflation (CPI) to be 5.3% and Wholesale Price Inflation (WPI) to be around 0.1% for February 2024.

Money & Finance: The government’s projection of 5.8% fiscal deficit for FY24 compared to the budgeted estimates of 5.9% and estimates of a 70 basis points cut in the fiscal deficit target for FY25, is expected to support investor sentiment. Government bond supply will remain low owing to lower budgeted borrowings, and demand is expected to remain high, on account on global bond (index) inclusion supporting the bond market going ahead. Dun & Bradstreet anticipates the 10-year G-Sec yield to moderate to around 7.1% in February 2024. The 15-91-day Treasury Bills yield is expected to increase to around 7.0%, primarily owing to continued liquidity deficit.

External Sector: Several factors, such as narrowing of trade deficit, buoyancy in the stock markets, build-up of forex reserves and positive investor sentiment on robust economic data, are likely to support the rupee, which is expected to continue to appreciate in February and March 2024. Dun & Bradstreet expects the rupee to appreciate to 83.0 per US$ in February 2024 and to 82.7 per US$ in March 2024.

Dr. Arun Singh, Global Chief Economist, Dun & Bradstreet, said, “India is set to achieve over 7% growth for the fourth consecutive year in FY25 — due to significant boost in capital expenditure — the highest in 21 years. However, external factors, such as challenges in global trade and finance, could impact India’s growth. Demand slowdown from key export destinations like UK and EU, is a concern, even more so for smaller businesses who are grappling with disruptions in key shipping routes. Additionally, risk aversion of financial institutions amid high interest rate environment is making funds expensive, particularly, for smaller businesses.”