The International Monetary Fund has forecast bullish GDP growth for India at 7.4 per cent in 2018 as against 6.7 per cent in the previous year. It forecast a better 7.8 per cent GDP growth for 2019, making India the fastest growing economy again overtaking China, which is expected to slow down to 6.6 per cent GDP in 2018 and 6.4 per cent in 2019. Of course, India and China growth figures are not comparable in absolute term. India is a mere $2.5 trillion economy while China is a huge $11 trillion economy. So even a ten per cent growth will add $250 billion to Indian economy and a mere five per cent growth in China will add $550 billion to the Chinese economy.

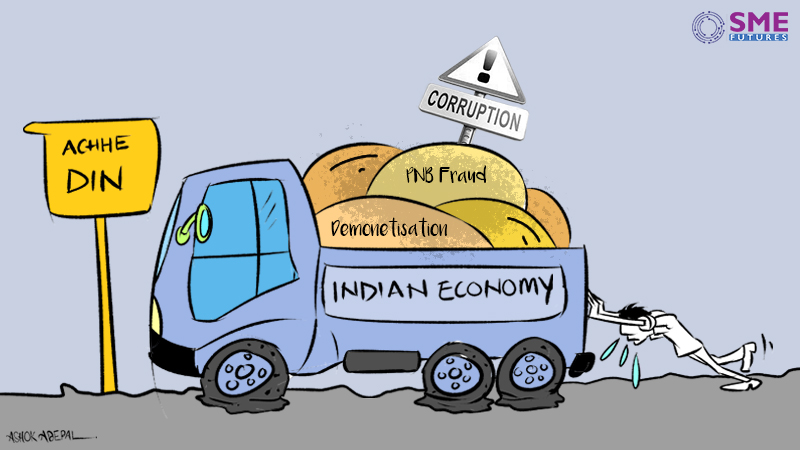

Nevertheless, it is a welcome development that green shoots are there in the Indian economy that too after a series of economic blunders in the last few years. The major one being demonetisation that has had a long-term negative impact. But lately, there are worrying signs as inflation is surging and the banking system is in doldrums due to series of scams and massive sub-prime lending to unviable infrastructure projects, particularly in highways and power sectors in the last few years. Falling rupee was putting pressure on interest rates and widening current account deficit due to high global crude oil prices were making the economic situation no better. Index of Industrial production touched a five-month low at 4.4 per cent in March.

The performance of eight core infrastructure, which accounted for 40 per cent of industrial production, was worse at 4.1 per cent in March, a four-month low. After clocking double-digit growth for a few months, India’s exports growth has faltered and it has nosedived to 5.1 per cent in March and trade deficit too has been widening on the back of rising global crude oil prices and falling rupee. India imports 80 per cent of its oil requirement, which is only growing year after year. The overall exports growth in 2017-18 was somewhat better at around 10 after being in negative territory in the previous years. India’s exports growth is nowhere near over 20 per cent cloaked annually during 2004-11. In this scenario, the road ahead is bumpy for India’s growth story.

The growth story and the bumpy road ahead

Though India has been in a sweet spot umpteen times in the last couple of decades, its economy never grows to its full potential despite economic reforms, which are happening incrementally since 1991 and are irreversible. China, South Korea and South East Asian countries, whose economies were more or less on par with India once, have leapfrogged, while India’s growth has been gradual and at time tottering despite democracy and good legal system.

China too had a large population base like India, yet in the last few decades, 600 million persons have come out of poverty in that country. China has done remarkably well in education and healthcare. Not only it has achieved 100 per cent literacy, malnutrition has virtually been eradicated and the entire population has been adequately skilled to get gainful employment, be it farming, manufacturing or any other vocation.

The usual prescription is that India should not waste time in pushing exports reforms to take advantage of improving global trade and push infrastructure development besides improving ease of doing business to return to high growth path. These are stereotyped prescription. The issue is why India misses the bus all the time. Why is it not able to tap its potential fully to leapfrog in growth just as other Asian emerging economies? The answer is simple: unbridled corruption at all level, which makes it high-cost economy. India may claim to have vibrant democracy but the political system makes the process slow and breeds corruption, which percolates right up to the bottom-most level. As a result, the so-called cheap labour and demographic dividend can never be fully utilized or exploited.

Aligarh is known for its lock making. But the cluster of the small-scale industry for centuries is not able to compete with China. The locks made in China thousands of miles away works out to be cheaper in Delhi than locks made in Aligarh 100 miles away from Delhi. The reason is high cost. A small item like lock costing Rs 50 is competitive when made in China despite high transportation cost and import duties. This is because labour is not only cheap but also better skilled improving efficiency manifold. China has better infrastructure with electricity being cheap, more efficient and available round the clock. Also, taxes are low there and ease of doing business is much better.

End corruption and improve governance

In India, the cost of production is very high because of inspector raj and need to pay bribe right from policemen to local political leaders. Massive theft and line losses make electricity charges very high due to inefficiency. This is true of all manufacturing and services. Even roadside vendors pay huge bribes to carry out his illegal business, which he recovers by selling at higher prices. Also, due to elections, whether parliament or assembly elections every six months, central government or some state governments are dysfunctional most parts of the year.

Frequent local bodies elections also contribute to the lack of administration during most part of the year. Former finance minister and BJP leader Jashwant Singh once said in parliament, improve governance and the rest will follow, be it economic growth or reforms. Prime Minister Narendra Modi promised in 2014 after coming to power that his government believed in ‘minimum government and maximum governance’ and development will be the main plank. Four years down the line that seems to have not happened not even semblance of it. India may claim to be on a sweet spot and perhaps most attractive investment destination. In practice, India is far from it. Without some soul searching by all on where we have gone wrong, it will take centuries to catch up with other emerging Asian economies. The only mantra is to end corruption and improve governance if the economy has to grow rapidly.

(PTI)