The Federation of All India Farmer Associations (FAIFA), a non-profit organisation representing the cause of millions of farmers and farmworkers of commercial crops across the states of Andhra Pradesh, Telangana, Karnataka, Gujarat, etc., has appealed to the government to cut duties on cigarettes to arrest its smuggling. FAIFA also had made a pre-budget representation to Finance Minister, Nirmala Sitharaman highlighting the growing menace of cigarette smuggling, resulting in various issues ranging from the rise of crime to huge tax losses to the government.

FAIFA has welcomed the recent government plans to cut duties for gold and top-end mobile phones which will result in the curbing of its smuggling. As per recent news reports, recognising that higher taxes makes gold smuggling more profitable, the government is planning to cut import duty on gold.

From the current 18.45 per cent, the government is considering bringing the rate to below 12 per cent. This will make gold cheaper in the Indian market and curb its smuggling. Similarly, there have been reports that to fight the rampant smuggling of very high end phones the Finance Ministry is looking at reducing the basic customs duty (BCD) on phones which have a CIF (cost, insurance and freight or price at landing in the port) value of over Rs 35,000–Rs 40,000.

While the government has taken the initiative to curb gold and mobile smuggling, cigarette smuggling is a far bigger issue.

Also Read: Union Budget 2023: FAIFA appeals for measures to curb cigarette smuggling

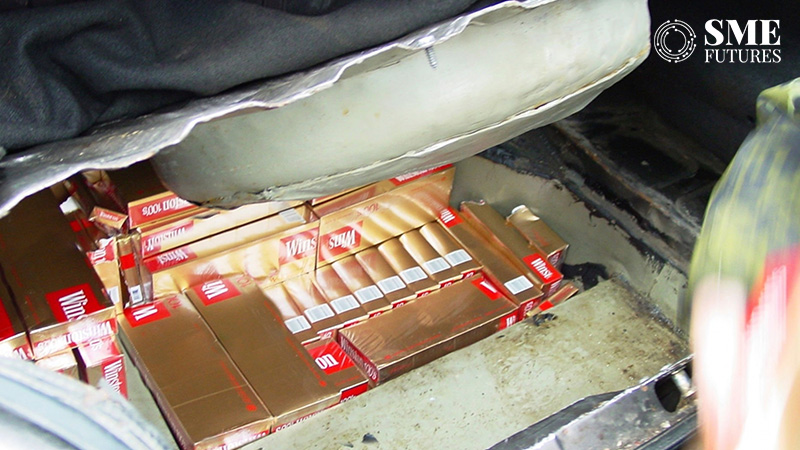

As per a FICCI CASCADE (Committee Against Smuggling and Counterfeiting Activities Destroying the Economy) report titled ‘Illicit Markets: A Threat to Our National Interests”, in terms of illicit market size, tobacco products stood at Rs 22,930 crore while that of mobile phones was Rs 15,884 crore. Again, government tax loss stood at Rs 13,331 crore for tobacco products, in comparison, tax loss for mobile phones was Rs 2,859 crore. Hence, if the government can take initiatives to curb smuggling for mobile then it should not ignore a product that is facing a bigger menace. A sharp rise in cigarette smuggling in recent months is increasing penetration of foreign tobacco in India, at the cost of Indian grown tobacco. This is affecting the Indian tobacco farmers. Recent seizures, which are a tip of the iceberg only, are a testimony to this.

Appealing to the government on-behalf of millions of tobacco farmers and farm workers who are reeling under distress because of extreme weather conditions, FAIFA President Javare Gowda said: “The reduction in taxes on legal cigarettes will not only reduce the huge tax loss for the government but also will bring relief to millions of our tobacco farmers who are dependent on the legal domestic industry. The huge taxes on tobacco has not resulted in the reduction of its consumption but it has only grown over the years which is being exploited by smugglers and creating an extra burden on our enforcement agencies and loss to our government and farmers. Illicit cigarettes are in big demand across the country and currently exceed 1/3rd of legal volumes and a tax cut will drastically reduce this market.”

Recent news has highlighted instances of cigarette smuggling. Very recently, Customs Department, Kolkata & RPF Howrah in a joint operation seized 3 lakh cigarette sticks of Esse Lights at Howrah Station. These stocks were seized before they could be loaded onto a South India-bound train. On January 19, in a joint operation, the Customs Department, Champhai and Assam Rifles recovered foreign origin cigarettes worth Rs 13 lakh in Mizoram.

Earlier in the new year, similar seizures had taken place. While the country was celebrating the dawn of the new year the Vijayawada Customs Preventive Commissionerate team was busy seizing a massive consignment of 30 lakh sticks (with a black market value of Rs 5 crore) of imported cigarettes of the Paris tobacco company, a European brand, near Narasaraopet town in Guntur district of Andhra Pradesh. Again, on January 5, 4 lakh cigarette sticks valued at Rs 30 lakh were seized by Mumbai Customs Officers at the Chhatrapati Shivaji Maharaj International Airport. These seizures are a result of concerted efforts of the government but the caught smuggled cigarettes are only the tip of the iceberg.

As per the DRI Annual Report, during 2021-22, 11 crore cigarette sticks valued at Rs 93 crore were seized. Despite hectic efforts by enforcement agencies, it is difficult to control cigarette smuggling because it is on average 50 percent cheaper in India and the arbitrage is huge for smugglers as the market size is quite large. As per a report by Euromonitor, presently India is the 4th largest illicit cigarette market in the world.

FAIFA General Secretary Murali Bab said: “Our farming community is under stress as consumers are shifting to smuggled cigarettes that do not use domestic tobacco. Since India has a huge and widespread dependence on the tobacco crop for livelihood, the government must reduce taxes for the legal tobacco industry. Such a tax reduction will make legal cigarettes cheaper in India and make smuggling less profitable.”

This thriving illicit market encouraged by high taxation and extreme regulation on the legal cigarette industry is the cause of many negative impacts on the country ranging from huge employment loss to loss of an astounding amount of tax revenue. As per the FICCI CASCADE report, the rampant cigarette smuggling in the country has led to a doubling of tax loss for the government from Rs 6,240 crore in 2012 to a massive Rs 13,331 crore in 2020, while scrupulous retailers and smugglers make high margins. The total employment opportunity lost in the sector is about 3.70 lakh.