Over the last two years, the micro, small and medium enterprises (MSMEs) have been at the receiving end of the government’s leap towards an integrated and clean economy. While no clear data exist on the jobs created and lost in the MSME sector, it is believed that more than two million people have lost jobs in this sector since 8 November 2016, the time when the government announced demonetisation of 86 per cent of currency notes in the economy.

The impact of demonetisation was followed up by the implementation of the goods and services tax (GST), which, due to higher compliance cost, has further dampened the spirits of the sector that contributes 45 per cent of India’s manufacturing output and employs 40 per cent of India’s workforce.

(Watch: What Modi government can do for MSMEs in Budget 2018)

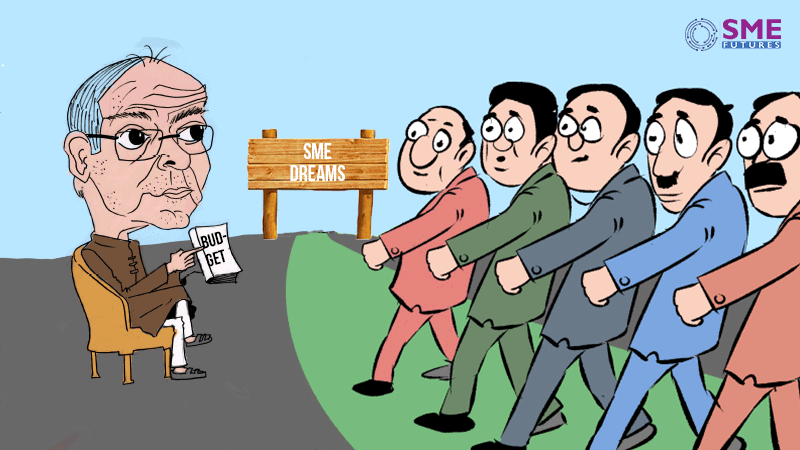

But, as the NDA government presents its final full budget before seeking a fresh mandate from the electorate, the biggest challenge for it is to counter the narrative of jobless growth. For many years, it was argued that it is the big industry that creates jobs, but finance minister Arun Jaitley last year acknowledged in a TV interview that the MSME sector creates more job than the big industry.

When Jaitley presents the Union budget on Thursday, he will be expected to do something special this year for the MSME sector. He has to walk a tightrope given the fiscal constraints facing his government. His success would depend upon his understanding of the MSME sector and the problems it is facing post-demonetisation and implementation of the GST. Here are the seven most important issues that the industry faces today. Jaitley must address these to help MSME sector achieve its full potential in the Indian economy.

Incentivise SMEs for Jobs

Since the 90s, finance ministers have followed the policy of incentivising investments from big corporates. It was a good policy as the big corporate houses were investing in labour-intensive technologies. But, over the past one decade, the advent of artificial intelligence (AI) has created an inverse relationship between investment and job creation.

However, given the small size of units in the MSME sector, AI is not feasible and every rupee invested in a company adds to the prospects of creating more jobs. If the government offers a tax break to SMEs for increasing the number of employees per unit, it will be the perfect reason for the SMEs to grow in size and in the process to generate more jobs in the country.

Promote Fund-Based Financing

MSMEs are accused of avoiding growing in size. It is alleged that to avoid taxes, labour laws and compliance costs that come with an increase in the size of a firm, MSME owners like to keep the size of their companies small. However, the reality is different. In most cases, a small enterprise fails to raise funds for bigger projects. This is due to the lack of project financing facility by banks.

There is reluctance among bankers to finance manufacturing units, particularly term loans, because they find manufacturing processes more risky in comparison with retail loans to purchase home and car.

The government should pitch a policy that mandates banks to increase the share of term loans to MSMEs beyond the normal prudential norm. This can be ensured by opening a special re-finance window for banks.

Make Land Resources Affordable

It is a regular practice for state governments to allot huge land parcels to big corporates at discounted rates. However, when an SME owner wants to set up a new workshop, she is compelled to purchase land or rent it at market rates. Unlike the big guys in the business, SMEs rely on industrial sheds and modular factories. Since land is a state subject, the Union government can introduce incentives for state governments to promote setting up of affordable work sheds and modular factories for small-scale industries. If this issue gets resolved, a large number of SMEs can generate higher revenue and can sustain lean periods without having to reduce their workforce.

Cut GST Compliance Cost

Since 1 July last year, the government has constantly assured the SMEs that the filing of GST will not be a cumbersome process. But, the reality is that it is one of the most complex tax-filing systems in the world and has increased the compliance cost for smaller players.

Under GST, every seller needs to file 37 tax returns in a year. While it is possible for a big company to afford a full-time chartered accountant, whose only job is to keep track of all the returns to be filed in a year, it is not possible for the small players to do the same. It is time that the government announces different norms for the small players, and what can be a better time than the budget time to make such an announcement?

Rethink Import Duties

To promote big domestic players, the government is using the route of increasing import price and introducing anti-dumping duty on foreign steel and other metal products. While this allows domestic steel companies to make more money, it makes the small industry non-competitive in the international market for exports.

Engineering sector has written several notes to the Ministry of Finance about the problems induced by higher import duty, but so far, the government has favoured the big guys. The government must take a call on this subject this year, as the higher cost of raw material is putting pressure on small-scale industries and many of them are on the verge of shutting down.

Talk SMEs for Ease of Doing Business

While India broke into Top 100 countries in the ease of business rankings prepared by the World Bank, it is largely on account of relaxed measures for big firms. Under the Companies Act, 2013, the Ministry of Corporate Affairs introduced a number of regulatory filings for the MSME sector. The act makes doing business difficult for MSMEs.

According to a note prepared by the Federation of Indian Micro, Small and Medium Enterprises (FISME), “Requirements like compulsory cost audits on all companies may be essential to take care of monopolistic pricing by power discoms and other private monopolies, but imposing them on privately held enterprises will only add a further burden of compliance costs.”

In its suggestion to the government, the FISME has argued that “cost accounting and cost audit is already applicable on all utilities/natural monopolies, like discoms, airports, railways, etc., but needs to be enforced. Private companies competing in an open economy should be excluded from compulsory cost audit”.

Focus on Textile Sector

The textile and garment industry is the largest job-generating sector within the SMEs. Although India’s exports have begun to pick up in recent months, this particular sector has been registering negative growth. The Confederation of Indian Textile Industry, in its memorandum submitted to the government, recently raised the issue of delay in refund of input tax credit. The association has demanded its refund at the fabric stage. The government should also consider exempting raw cotton from five per cent GST when purchased directly from the farmers under the reverse or forward charge mechanism. This measure will reduce blockage of working capital at the time of procurement of inputs.

Among other measures, the government should consider reduction of GST on artificial fibres from 18 per cent to 12 per cent, as it provides more jobs and produces higher value addition.