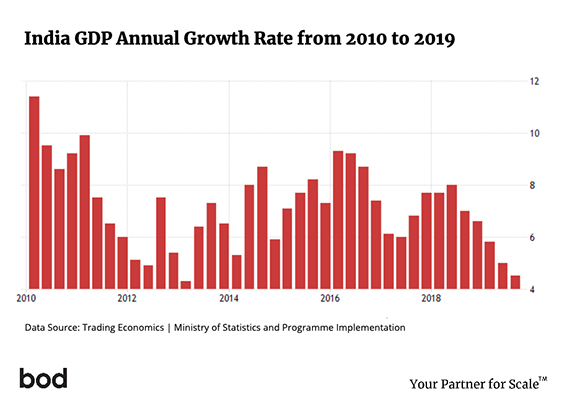

Indian Finance Minister, Nirmala Sitharaman, made a slew of announcements in the Union Budget 2020-21 to recover the slumping GDP growth. Almost all industries, from automobile and FMCG to real estate, continue to experience the impact of the FY 2019-20 downturn.

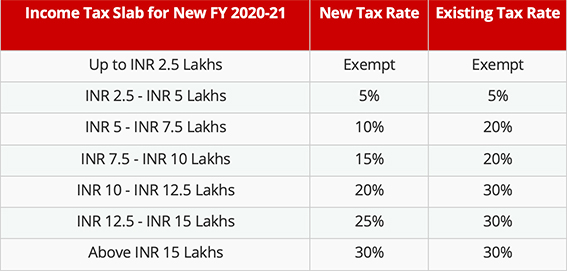

One of the measures announced in the budget is a new personal income tax regime. The reform comes as a relief for individuals & corporations alike. It is expected to increase the country’s consumer spending propensity and thereby help in economic recovery.

As per the Finance Minister’s speech, the tax rates are optional. An individual may choose the current rates or the new ones depending upon the concessions & allowances they might want to declare. The Finance Minister shared that this new regime will cost the Government of India an estimated INR 40,000 crores in annual revenue. The objective of this projected loss in revenue is to revive consumer spending; that declined over the past year.

The belief is that a reduction in tax rates will provide taxpayers with more disposable income, and thereby increase their spending propensity in the coming financial year. However, considering the small proportion of taxpayers in the country, it’s unclear how the measure will help the economy as a whole.

Reviewing the need for reform

The layoffs and declining revenues in the automobile industry have been making headlines since the last few months. It’s not just the leading car makers like Maruti who have suffered, but also mid and small-sized companies that manufacture car parts and accessories. Along with this sector, other industries like real estate and FMCG are also struggling with declining growth rates. Even though the FMCG industry grew by 9.7% in 2019, the growth stagnation in rural areas is a cause of concern for firms of all sizes in the sector.

The trigger of this growth deceleration is believed to be the lapses in the banking and lending sector, starting with Infrastructure Leasing & Financial Services’ (IL&FS) downfall. In a domino effect, it affected all other industries, in addition to steering the unemployment rate to an all-time high.

Prima facie, it’s going to be quite a task for the government to pull the economy out of this complex situation. The new budget, with its tax reform scheme and others, certainly brings hope to many industries. MSMEs were expecting a concession on personal income tax to see a revival in growth, and they have it, but what is the real impact the new tax reform scheme will entail?

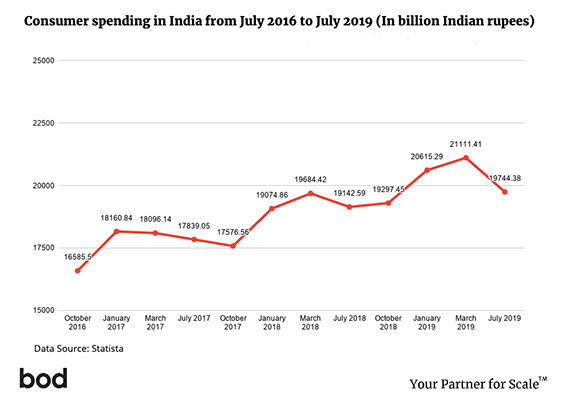

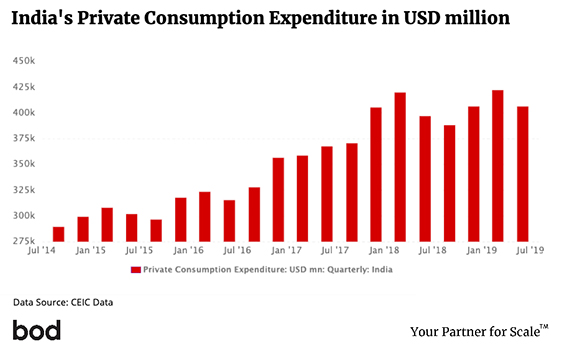

Private consumption growth will take more time to recover

A significant portion of the GDP is made up of private consumption, i.e. consumer spending on goods and services. As evident from the graph above, there hasn’t been any significant growth since January 2018, and the consumption has fallen further in the 3rd quarter of FY2019-20. The private consumption growth rate in FY2018-19 was 7.2%; it is expected to go down further in this fiscal. The new tax regime is aimed at turning around this decline in the growth rate. Still, in all likelihood, only a small portion of the population will be affected directly.

There are around 58.7 million individual income taxpayers in the country. The ones to benefit the most from the new system are those in the INR 5 Lakhs to INR 15 Lakhs tax bracket, i.e. around 18.16 mn individuals.

To understand the impact better, let’s divide the estimated INR 40,000 crore of revenue hit uniformly. The result would be a small amount of savings per individual, roughly INR 22,026 per annum. The amount is not enough to create a significant shift in their current spending habits. Hence, this reform alone is not sufficient to recover the economy. Even if the middle class starts spending more, the ripple effect will take some time to reach rural India, an area key to economic progress.

Need to put money in the hands of rural consumers

What will make an actual, real difference are the budgetary allocations dedicated to boosting agriculture and infrastructure? The Finance Minister shared that the government is committed to doubling the average Indian farmers’ income by 2022 and proposed 16 action points to aid them in the budget. Additionally, reforms for the fisheries, transport infrastructure, irrigation industries, etc. will further drive the agricultural output. It will additionally reduce the burden on the FMCG companies which are facing pricing pressure because of increasing prices of raw materials like wheat, palm oil, etc.

So, to grow private consumption, it’s essential to improve the purchasing power of a large part of the population. More direct efforts need to be made to create employment opportunities in rural India, along with providing income support to low-income families.

Schemes like Pradhan Mantri Kisan Samman Nidhi (PMKISAN) which are meant to address the same can do better with more funding.

Nonetheless, with the reduction in corporate tax and the push for electronics manufacturing, infrastructure, etc., there will be plenty of opportunities for individual companies to play their cards right and recover their growth.

This article was written by Sugandh Dhawan & Divya Rathore from BOD. To get in touch with the author/s, please write to sugandh.dhawan@bod.consulting.